This text was obtained via automated optical character recognition.

It has not been edited and may therefore contain several errors.

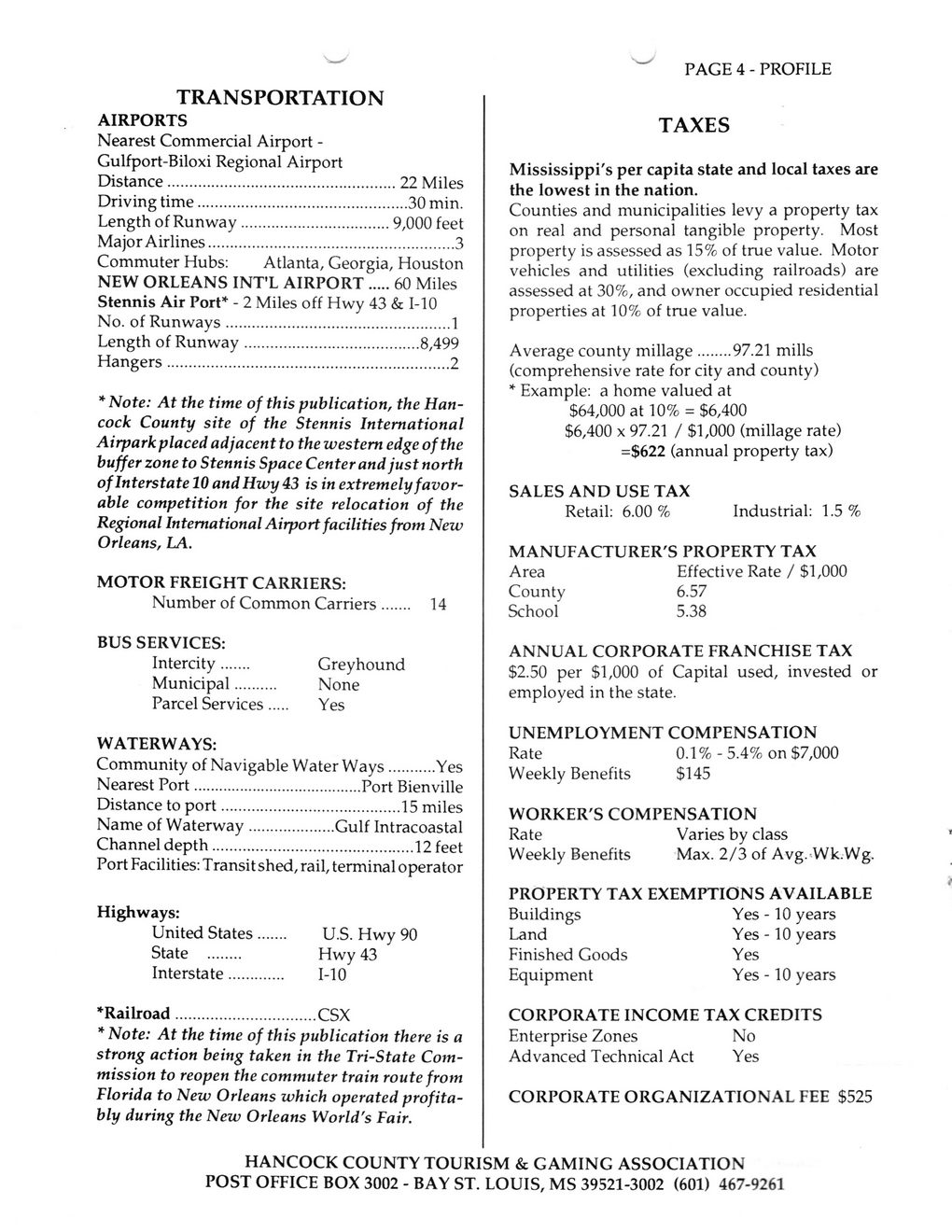

PAGE 4 - PROFILE TRANSPORTATION AIRPORTS Nearest Commercial Airport -Gulfport-Biloxi Regional Airport Distance............................22 Miles Driving time.........................30 min. Length of Runway..................9,000 feet Major Airlines............................3 Commuter Hubs: Atlanta, Georgia, Houston NEW ORLEANS INT'L AIRPORT..........60 Miles Stennis Air Port* - 2 Miles off Hwy 43 & 1-10 No. of Runways.............................1 Length of Runway.......................8,499 Hangers....................................2 *Note: At the time of this publication, the Hancock County site of the Stennis International Airpark placed adjacent to the western edge of the buffer zone to Stennis Space Center and just north of Interstate 10 and Hwy 43 is in extremely favorable competition for the site relocation of the Regional International Airport facilities from New Orleans, LA. MOTOR FREIGHT CARRIERS: Number of Common Carriers...... 14 BUS SERVICES: Intercity.... Municipal....... Parcel Services Greyhound None Yes WATERWAYS: Community of Navigable Water Ways...........Yes Nearest Port.......................Port Bienville Distance to port.......................15 miles Name of Waterway...............Gulf Intracoastal Channel depth............................12 feet Port Facilities: Transit shed, rail, terminal operator Highways: United States State ........ Interstate.... U.S. Hwy 90 Hwy 43 1-10 •Railroad.....................CSX * Note: At the time of this publication there is a strong action being taken in the Tri-State Commission to reopen the commuter train route from Florida to New Orleans which operated profitably during the New Orleans World's Fair. TAXES Mississippi's per capita state and local taxes are the lowest in the nation. Counties and municipalities levy a property tax on real and personal tangible property. Most property is assessed as 15% of true value. Motor vehicles and utilities (excluding railroads) are assessed at 30%, and owner occupied residential properties at 10% of true value. Average county millage......97.21 mills (comprehensive rate for city and county) * Example: a home valued at $64,000 at 10% = $6,400 $6,400 x 97.21 / $1,000 (millage rate) =$622 (annual property tax) SALES AND USE TAX Retail: 6.00% Industrial: 1.5% MANUFACTURER'S PROPERTY TAX Area Effective Rate / $1,000 County 6.57 School 5.38 ANNUAL CORPORATE FRANCHISE TAX $2.50 per $1,000 of Capital used, invested or employed in the state. UNEMPLOYMENT COMPENSATION Rate 0.1%-5.4% on $7,000 Weekly Benefits $145 WORKER'S COMPENSATION Rate Varies by class Weekly Benefits Max. 2/3 of Avg. Wk.Wg. PROPERTY TAX EXEMPTIONS AVAILABLE Buildings Yes -10 years Land Yes -10 years Finished Goods Yes Equipment Yes -10 years CORPORATE INCOME TAX CREDITS Enterprise Zones No Advanced Technical Act Yes CORPORATE ORGANIZATIONAL FEE $525 HANCOCK COUNTY TOURISM & GAMING ASSOCIATION POST OFFICE BOX 3002 - BAY ST. LOUIS, MS 39521-3002 (601) 467-9261

BSL 1981 To 1990 Tourism-And-Gaming-Area-Profile-(5)